In the realm of financial decision-making, understanding the profitability and viability of an investment is critical. Net Present Value (NPV) is a widely used financial metric that helps determine the value of an investment by taking into account the time value of money. NPV break-even analysis takes this concept further by providing insight into the point at which the NPV of an investment reaches zero, indicating the break-even point. In this article, we will explore the basics of NPV break-even analysis, its significance, calculation methodology, interpretation, and practical applications.

Understanding Net Present Value (NPV)

Before delving into NPV break-even analysis, it is important to understand the concept of net present value (NPV). NPV measures the difference between the present value of the cash inflows and outflows associated with an investment, taking into account the discount rate. By discounting future cash flows to their present value, NPV accounts for the time value of money and provides a more accurate assessment of the profitability of an investment. A positive NPV indicates that the investment is expected to generate more cash inflows than outflows, making it potentially lucrative.

Explore the concept of breakeven

The break-even point represents the point at which an investment’s cumulative cash inflows equal its cumulative cash outflows, resulting in an NPV of zero. At this point, the investment neither generates a profit nor incurs a loss. By identifying the break-even point, NPV break-even analysis provides valuable insight into the time it takes for an investment to recoup its initial costs and begin generating positive returns. It serves as a critical decision-making tool to help evaluate the risk and profitability of an investment.

The Importance of NPV Break-Even Analysis

NPV break-even analysis provides several significant benefits to decision makers. First, it provides a clear indication of the time required for an investment to become financially viable. This information helps manage cash flow expectations and adjust financial planning accordingly. In addition, NPV break-even analysis allows comparisons to be made between different investment options, enabling decision-makers to select the option with the shortest break-even period or the highest potential for profitability.

Key Components of the NPV Break-Even Calculation

There are several components to the NPV break-even calculation. These include the initial investment amount, the expected cash inflows and outflows over the life of the investment, and the discount rate used to calculate the present value of future cash flows. By carefully analyzing these components, decision makers can gain a comprehensive understanding of the financial dynamics of the investment and the break-even point.

Step-by-Step Guide to Calculating NPV Break-Even

Calculating NPV Break-Even requires a systematic approach. This step-by-step guide outlines the key steps involved, including determining the initial investment, estimating future cash flows, selecting an appropriate discount rate, and iteratively calculating the NPV until it reaches zero. By following this guide, decision makers can perform a reliable NPV break-even analysis and make informed investment decisions.

Considerations and Assumptions in NPV Break-Even Analysis

NPV break-even analysis is subject to certain considerations and assumptions. These include the accuracy of cash flow estimates, the reliability of the discount rate, the time horizon for cash flow projections, and the stability of economic and market conditions. Decision makers must be aware of these factors and exercise caution in making assumptions to ensure the validity and reliability of the analysis.

Interpreting and Using NPV Break-Even Results

Interpreting the results of an NPV break-even analysis is critical to decision making. A break-even point that occurs relatively early indicates a shorter payback period and a faster return on investment. On the other hand, a longer break-even period may indicate higher risk or lower profitability. Decision makers should carefully analyze NPV break-even results in conjunction with other financial metrics and qualitative factors to make informed investment decisions.

Sensitivity Analysis and Risk Assessment in NPV Break-Even

Performing sensitivity analysis and assessing risks associated with NPV break-even analysis enhances decision making. Sensitivity analysis helps identify the key variables that have a significant impact on break-even and NPV. By considering different scenarios and assessing risk factors, decision makers gain insight into the potential variability and uncertainty associated with the financial results of the investment.

Limitations and Caveats of NPV Break-Even Analysis

While NPV break-even analysis is a valuable tool, it has certain limitations. It assumes that cash flows will remain consistent and predictable over the life of the investment, which may not always be the case. In addition, it relies on accurate estimates of cash flows and discount rates, which introduces potential sources of error. Decision-makers should be aware of these limitations and use NPV break-even analysis in conjunction with other financial and non-financial factors.

Real world applications and examples of NPV Break-Even

NPV Break-Even analysis has applications in various industries and sectors. It is commonly used in capital budgeting decisions, project evaluations, and business investment assessments. For example, it can be used to determine the break-even point and financial viability of launching a new product, investing in a capital-intensive project, or acquiring another company. Real-world examples and case studies can provide practical insights into how organizations have used NPV break-even analysis to inform their decision-making processes.

Conclusion: Using NPV Break-Even to Inform Decision Making

NPV break-even analysis is a powerful financial tool that helps decision makers evaluate the profitability and risk associated with an investment. By calculating the break-even point and accounting for the time value of money, NPV break-even analysis provides valuable insight into the financial dynamics and viability of an investment. It helps decision makers evaluate payback periods, compare investment options, and manage cash flow expectations. However, it is important to recognize the assumptions and limitations of this analysis and to supplement it with other financial and non-financial considerations. By using NPV break-even analysis effectively, decision-makers can make informed decisions that align with their organization’s strategic goals and enhance long-term financial success.

FAQ

How do you calculate NPV break even?

To calculate the NPV break-even point, follow these steps:

- Determine the amount of the initial investment.

- Estimate the expected cash inflows and outflows over the life of the investment.

- Choose an appropriate discount rate.

- Calculate the net present value (NPV) of each cash flow by discounting it to its present value using the selected discount rate.

- Add the NPVs of all the cash flows.

- Continue to adjust the discount rate and recalculate the NPV until it reaches zero.

- The point at which the NPV reaches zero represents the break-even point.

By iterating through these steps and determining the discount rate that results in an NPV of zero, you can calculate the NPV break-even point and gain insight into the financial viability and profitability of an investment.

What is net present value?

Net present value (NPV) is an indicator of the dynamic calculation of investment. Investors use NPV to determine the value of future payments and income at the present time. In this way, amounts from different calculation periods can be compared and different investment opportunities can be contrasted with regard to their profitability.

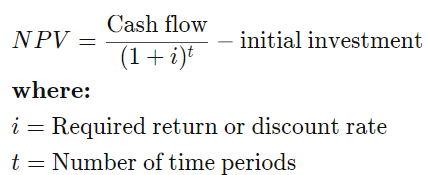

Net Present Value (NPV) Formula

It is used for the valuation of different investment options. By calculating the NPV of different investments we will know with which of them we are going to obtain a higher profit.

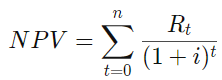

If analyzing a longer-term project with multiple cash flows, then the formula for the NPV of a project is as follows:

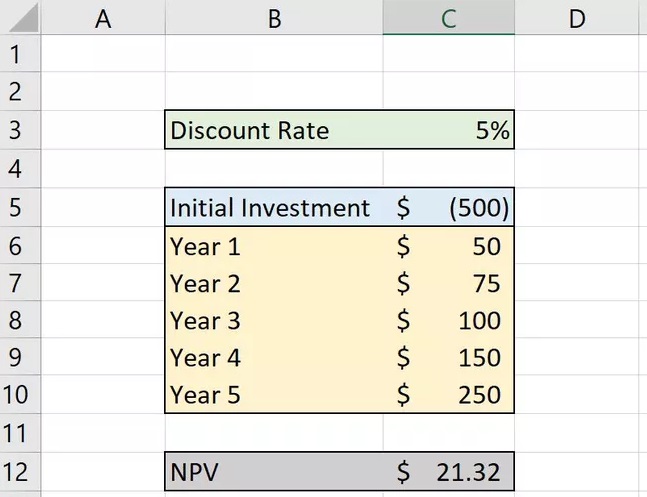

How to Calculate NPV Using Excel

In Excel, there is a NPV function that can be used to easily calculate net present value of a series of cash flow.

The NPV function in Excel is simply NPV, and the full formula requirement is:

=NPV(discount rate, future cash flow) + initial investment

In the example above, the formula entered into the grey NPV cell is:

= NPV (green cell, yellow cells) + blue cell

= NPV (C3, C6:C10) + C5

A series of future cash flows can alternate between positive and negative returns. After an initial cash outflow, a company may expect to need to repair equipment, pay property taxes on land, or incur selling costs for a given number of capital projects.

How do you calculate the NPV of a break-even point?

Quote from video: And the formula is you take fixed costs. And divide divided by price minus variable costs.

Is NPV zero at break-even point?

Interpreting the Net Present Value (NPV)

If NPV > 0: Accept (Profitable) If NPV = 0: Indifferent (Break-Even Point)

How do you calculate NPV with even cash flows?

What is the formula for net present value?

- NPV = Cash flow / (1 + i)^t – initial investment.

- NPV = Today’s value of the expected cash flows − Today’s value of invested cash.

- ROI = (Total benefits – total costs) / total costs.

How do you calculate break-even amount?

How to calculate your break-even point

- When determining a break-even point based on sales dollars: Divide the fixed costs by the contribution margin. …

- Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin.

- Contribution Margin = Price of Product – Variable Costs.

How do you calculate NPV example?

Example showing how to calculate NPV

To calculate the NPV of your cash flow (earnings) at the end of year one (so t = 1), divide the year one earnings ($1001) by 1 plus the return (0.10). NPV = Rt/(1 + i)t = $1001/(1+1.10)1 = $90.90. The result is $91 (rounded to the nearest dollar).

How do I manually calculate NPV in Excel?

Quote from video: We will apply the NPV. On each go to the cell where you want the function to be calculated. And type the following equals NPV our discount rate divided by 12 as the rate is compounded monthly.

How do you calculate NPV with uneven cash flow in Excel?

As we’ve seen, we can use the NPV function to calculate the present value of the uneven cash flows in this example. Then, we need to subtract the $800 cost of the investment. Therefore, the formula to calculate the net present value is: =NPV(B1,B5:B9)+B4 and the answer is $200.18.

How do you calculate NPV for 5 years?

NPV can be calculated with the formula NPV = ⨊(P/ (1+i)t ) – C, where P = Net Period Cash Flow, i = Discount Rate (or rate of return), t = Number of time periods, and C = Initial Investment.

What is the NPV formula in Excel?

The Excel NPV function is a financial function that calculates the net present value (NPV) of an investment using a discount rate and a series of future cash flows. rate – Discount rate over one period. value1 – First value(s) representing cash flows.

What is NPV and how it is calculated?

NPV is calculated by taking the present value of all cash flows over the life of a project. Then, the present value of cash flows is subtracted from the investment’s initial investment. If the difference is positive (greater than 0), the project will be profitable.

What is NPV explain with examples?

Net Present Value (NPV) refers to the dollar value derived by deducting the present value of all the cash outflows of the company from the present value of the total cash inflows and the example of which includes the case of the company A ltd.

What rate do you use for NPV?

It’s the rate of return that the investors expect or the cost of borrowing money. If shareholders expect a 12% return, that is the discount rate the company will use to calculate NPV. If the firm pays 4% interest on its debt, then it may use that figure as the discount rate.

How do you calculate present value with different payments?

The formula for determining the present value of an annuity is PV = dollar amount of an individual annuity payment multiplied by P = PMT * [1 – [ (1 / 1+r)^n] / r] where: P = Present value of your annuity stream. PMT = Dollar amount of each payment. r = Discount or interest rate.

Can the present value of uneven cash flows be calculated?

When a cash flow stream is uneven, the present value (PV) and/or future value (FV) of the stream are calculated by finding the PV or FV of each individual cash flow and adding them up.

Why does Excel calculate NPV wrong?

MBA 505 Video Lecture 3 Breakeven NPV)

What is even cash flow?

An even cash flow of regularly scheduled payments defines an annuity. If you borrow money to start your business, the monthly payments are calculated using an annuity formula. Two basic annuity formulas exist: annuities with a fixed payment period and perpetual annuities that continue forever.

What is uneven cash flow?

Uneven Cash Flow Stream. Any series of cash flows that doesn’t conform to the definition of an annuity is considered to be an uneven cash flow stream. For example, a series such as: $100, $100, $100, $200, $200, $200 would be considered an uneven cash flow stream.

What discount rate should I use for NPV?

The 10% discount rate is the appropriate (and stable) rate to discount the expected cash flows from each project being considered.

How do I calculate present value of cash flows in Excel?

Present value (PV) is the current value of an expected future stream of cash flow. Present value can be calculated relatively quickly using Microsoft Excel. The formula for calculating PV in Excel is =PV(rate, nper, pmt, [fv], [type]).

Why is NPV in Excel wrong?

Why do so many people get it wrong? Well, contrary to popular belief, NPV in Excel does not actually calculate the Net Present Value (NPV). Instead, it calculates the present value of a series of cash flows, even or uneven, but it does NOT net out the original cash outflow at time period zero.

What is the project’s NPV calculator?

It helps you to determine if a project is worth the investment. The NPV calculator consists of a formula box where you enter the initial investment, discount rate, and the number of years. You choose the nature of inflows, and the calculator will show you the present value of cash inflows and the net current value.