Return on Investment (ROI) is a commonly used financial metric that helps measure the profitability and efficiency of an investment. It is a critical decision-making tool in a variety of business contexts because it provides insight into the financial performance and potential returns of an investment. When calculating ROI, it is important to consider all relevant factors, including depreciation, which can significantly impact the accuracy and completeness of the analysis.

The role of depreciation: Exploring its Impact on the ROI Calculation

Depreciation is an accounting concept that reflects the gradual decline in the value of an asset over its useful life. It is a non-cash expense that accounts for the wear and tear, obsolescence, or use of tangible assets such as buildings, machinery, or vehicles. Depreciation is an important consideration in the ROI calculation because it directly affects the net book value of the asset and, therefore, the overall profitability assessment.

Components of the ROI Calculation: Accounting for Depreciation and Other Factors

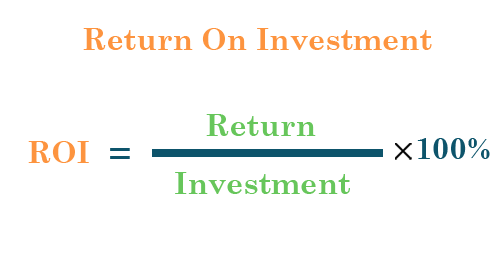

To calculate ROI, the formula typically involves dividing the net profit of an investment by the initial cost of the investment and expressing it as a percentage. However, the net profit should be adjusted to account for depreciation. By including depreciation in the calculation, the analysis becomes more complete and accurate because it accounts for the declining value of the asset over time.

Depreciation and Asset Value: How It Affects the ROI Calculation

Depreciation affects the value of the asset on the balance sheet by reducing its book value over time. Since ROI takes into account the initial cost of the investment, ignoring depreciation can result in an inflated ROI figure. This omission can misrepresent the true profitability of the investment by failing to recognize the gradual loss of value of the asset. By including depreciation, the ROI calculation provides a more realistic representation of the return on investment.

Depreciation Methods: Impact on ROI Analysis

Different depreciation methods, such as straight-line depreciation, declining balance depreciation, or unit-of-production depreciation, can be used to allocate the cost of an asset over its useful life. The choice of depreciation method affects the ROI analysis. Each method affects the timing and amount of depreciation expense, which affects net income and, therefore, the ROI calculation. It is important to select an appropriate depreciation method that is consistent with the characteristics of the asset and industry standards.

Adjusting ROI for Depreciation: Different Approaches and Considerations

When including depreciation in the ROI calculation, there are several approaches to accounting for this expense. One common method is to subtract the annual depreciation expense from the net income before dividing it by the initial investment cost. Another approach is to subtract accumulated depreciation from the original cost of the asset to determine the adjusted capital cost. Either method provides a more accurate representation of the profitability of the investment by taking into account the impact of depreciation.

Evaluating ROI: The Importance of Including Depreciation in Financial Analysis

Including depreciation in the ROI calculation improves the accuracy and reliability of financial analysis. By accounting for the gradual loss of asset value, the ROI metric becomes more comprehensive and reflects the true profitability of the investment. This allows companies and investors to make informed decisions based on a more accurate assessment of the returns being generated. Ignoring depreciation can lead to misleading conclusions and suboptimal resource allocation and investment decisions.

In conclusion

Including depreciation in the ROI calculation is essential for a comprehensive and accurate assessment of investment profitability. Depreciation affects the value of an asset over time, and ignoring it can distort the ROI figure. By accounting for depreciation, companies and investors gain a clearer understanding of the true return on investment and can make more informed decisions. Accounting for depreciation increases the reliability of ROI analysis and ensures a more accurate assessment of investment performance.

FAQ

Do you include depreciation in ROI calculation?

Yes, it is important to include depreciation in return on investment (ROI) calculations. Depreciation is the gradual decrease in the value of an asset over its useful life. Including depreciation makes the analysis more accurate and comprehensive because it accounts for the decreasing value of the asset over time. Ignoring depreciation can lead to an inflated ROI figure that misrepresents the true profitability of the investment. Including depreciation in the ROI calculation provides a more realistic picture of the return on investment and allows for informed decision-making based on a thorough assessment of profitability. It ensures that the impact of asset depreciation is properly accounted for in the analysis, resulting in more reliable and insightful financial evaluations.

What is ROI?

ROI (return on investment) or ROR (rate of return) – a financial ratio illustrating the level of profitability or loss of a business, taking into account the amount of investments made in the business. ROI is usually expressed as a percentage, less often as a fraction. This indicator may also have the following names: return on investment, return on investment, return on invested capital, rate of return.

ROI is the ratio of the amount of profit or loss to the amount of investment. The profit value can be interest income, accounting profit/loss, management profit/loss, or net profit/loss. The investment amount can be the assets, equity, principal amount of the business, or other monetary investments.

What is included in ROI calculation?

Return on investment (ROI) is the ratio of profit to investment spent. ROI shows:

whether the investment has paid off;

Whether you made a profit.

This is what the simplest formula for estimating ROI looks like:

If ROI is less than 0% – you incurred a loss.

If it is equal to 0% – the investment has paid off, but there is no profit.

If it’s greater than 0% – you made a profit.

Return on investment (ROI) is an approximate measure of an investment’s profitability. ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and, finally, multiplying it by 100.

How does depreciation affect ROIC?

Since depreciation is a direct expense, it will reduce the net profit of the company. The lower the net profit, the lower the return on total assets will be. Therefore, depreciation and rate of return on total assets are inversely correlated.

How do you calculate return on investment with depreciation?

You can calculate the ROI by dividing the net profit (net present value minus cost) by the investment costs, then multipyling the number by 100 to get the ROI percentage. It is possible to have a negative ROI, as objects depreciate over time.

Do you include fixed costs in ROI?

You can’t ignore the fixed costs – you will incur fixed costs regardless of what you deliver in the release. To determine the true cost of each feature in the release you must include both the fixed and variable costs. Unfortunately, you can’t determine the true cost – you can only approximate it.

How does Warren Buffett calculate ROIC?

We can express Buffett’s idea by the Dupont formula, which is essentially:

- ROIC = Earnings/Sales x Sales/Capital.

- High ROIC Businesses with Low Capital Requirements.

- Businesses that Require Capital to Grow; Produce Adequate Returns on that Capital.

Is depreciation subtracted from total assets?

Accumulated depreciation is used to calculate an asset’s net book value, which is the value of an asset carried on the balance sheet. The formula for net book value is cost an asset minus accumulated depreciation.

How do you calculate ROI manually?

This is displayed as a percentage, and the calculation would be: ROI = (Ending value / Starting value) ^ (1 / Number of years) -1. To figure out the number of years, you’d subtract your starting date from your ending date, then divide by 365.

What is included in operating assets for purposes of calculating ROI?

Examples of operating assets include cash, accounts receivable, prepaid assets, buildings, and equipment. As long as the division uses the assets to produce operating income, they are included in the operating assets category.

Is ROI based on revenue or profit?

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage.

What is the difference between ROI and ROIC?

While the ROIC considers all of the activities a company undertakes to generate a profit, the return on investment (ROI) focuses on a single activity. You get the ROI by dividing the profit from that single activity (gain – cost) by the cost of the investment.

What is Berkshire Hathaway ROIC?

Berkshire Hathaway’s latest twelve months return on invested capital is 2.1%. Berkshire Hathaway’s return on invested capital for fiscal years ending December averaged 9.8%. Berkshire Hathaway’s operated at median return on invested capital of 10.0% from fiscal years ending December .

What is a good return on invested capital percentage?

What is a good Return on Invested Capital benchmark? As a rule of thumb, ROIC should be greater than 2% in order to create value.

How do you calculate ROI for a project?

The formula for ROI is typically written as:

- ROI = (Net Profit / Cost of Investment) x 100.

- ROI = [(Financial Value – Project Cost) / Project Cost] x 100.

- Expected Revenues = 1,000 x $3 = $3,000.

- Net Profit = $3,000 – $2,100 = $900.

- ROI = ($900 / $2,100) x 100 = 42.9%

- Actual Revenues = 1,000 x $2.25 = $2,250.

Is ROI and IRR the same?

ROI is the percent difference between the current value of an investment and the original value. IRR is the rate of return that equates the present value of an investment’s expected gains with the present value of its costs. It’s the discount rate for which the net present value of an investment is zero.

What is a good ROI for a project?

Frequently Asked Questions (FAQ) about project ROI

Typically a range of 5% to 10% is viewed as a good target return.

Does ROIC include depreciation?

ROIC is to the balance sheet what net profit is to the P&L. A common criticism of relying upon EBITDA to evaluate the cash flow of a business is that interest and taxes are true cash costs. Additionally, depreciation and amortization are also cash costs, but from prior periods.

Why is depreciation added to cash flow?

Why is depreciation added in cash flow? It’s simple. Depreciation is a non-cash expense, which means that it needs to be added back to the cash flow statement in the operating activities section, alongside other expenses such as amortization and depletion.

Does depreciation affect retained earnings?

Retained earnings are directly impacted by the same items that impact net income. These include revenues, cost of goods sold, operating expenses, and depreciation.

What effect does depreciation have on cash flow?

Depreciation does not have a direct impact on cash flow. However, it does have an indirect effect on cash flow because it changes the company’s tax liabilities, which reduces cash outflows from income taxes.

Is depreciation included in NPV?

Depreciation is not an actual cash expense that you pay, but it does affect the net income of a business and must be included in your cash flows when calculating NPV. Simply subtract the value of the depreciation from your cash flow for each period.

Why is depreciation not included in the cash flow statement?

Depreciation is considered a non-cash expense, since it is simply an ongoing charge to the carrying amount of a fixed asset, designed to reduce the recorded cost of the asset over its useful life.